Working tax calculator

How It Works. Tax Deductions and Tax Credits.

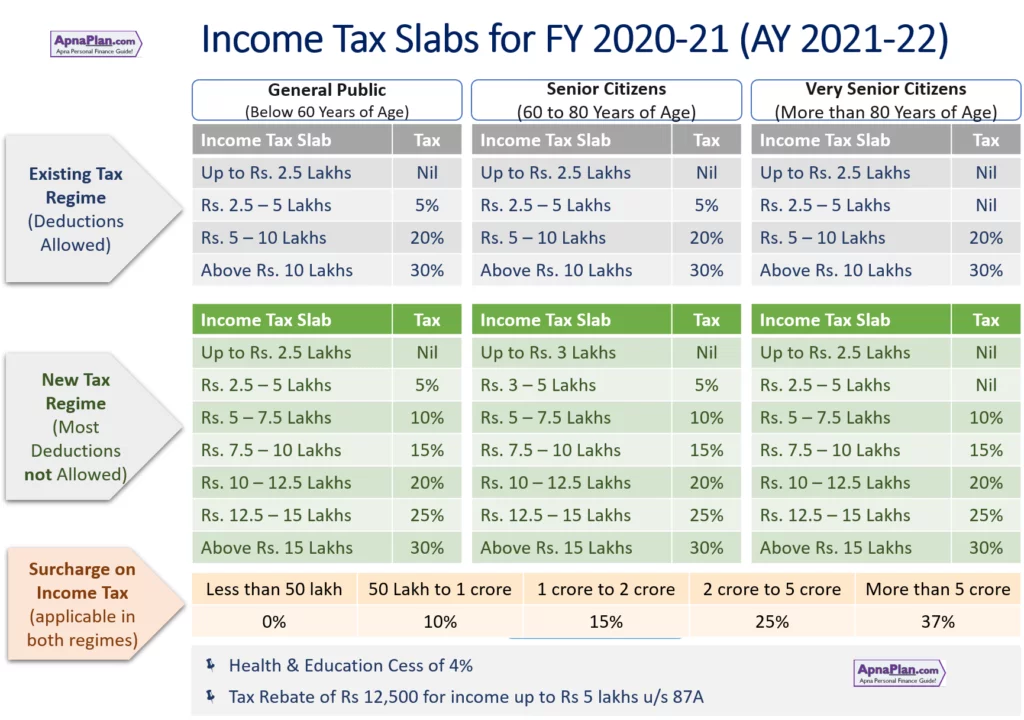

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

How to use BIR Tax.

. The calculator takes you through the process of. Using the United States Tax Calculator is fairly simple. Your household income location filing status and number of personal.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Avalara helps you automate the process for assessing collecting and remitting comms tax. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023.

Using the United States Tax Calculator. If you work for yourself you need to pay the self-employment tax which is equal to both the employee and employer portions of the FICA taxes 153 totalLuckily when you file your. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect.

Communications tax is complicated but Avalara can help make it easier to stay compliant. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Income tax for individuals Te tāke moni whiwhi mō ngā tāngata takitahi. No Matter What Your Tax Situation Is TurboTax Has You Covered. What your take home salary will be when tax and the Medicare levy are removed.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. First enter your Gross Salary amount where shown. Communications tax is complicated but Avalara can help make it easier to stay compliant.

In May of 2022 the Federal Reserve reported an average interest rate of 1665. Working Tax Credit - how much money you get hours you need to work eligibility. Your marginal tax rate.

Helps you work out. Next select the Filing Status drop down. See how your refund take-home pay or tax due are affected by withholding amount.

Discover Helpful Information And Resources On Taxes From AARP. Sign Up Today And Join The Team. In the Secondary settings put the gross value of all of your other income including primary income.

Ad Avalara helps you automate the process for assessing collecting and remitting comms tax. The advantage of pre-tax contributions is that. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Individuals and families Ngā tāngata me ngā whānau. Tax credits calculator - GOVUK. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Check the secondary income box. Sign Up Today And Join The Team.

North Carolina has not always had a flat income tax rate though. The average credit card interest rate in 2021 was 1645. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

How much Australian income tax you should be paying. Your household income location filing status and number of personal. Over 900000 Businesses Utilize Our Fast Easy Payroll.

This tells you your take-home. Benefit fraud Benefits calculators Tax credits. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

That means that your net pay will be 40568 per year or 3381 per month. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Learn About Payroll Tax Systems.

What Is the Average Credit Card Interest Rate. File my individual tax return Te tuku i. May not be combined with other.

Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed. Use this tool to. Estimate your federal income tax withholding.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Import Your Tax Forms And File With Confidence. IRD numbers Ngā tau IRD.

Learn About Payroll Tax Systems. Appeals and complaints and Tax credits. Ad Time To Finish Up Your Taxes.

Our Working from Home Tax Relief Calculator lets you get to the final number for your Self Assessment expenses quickly and easily. How do I calculate tax on secondary income.

Ontario Income Tax Calculator Wowa Ca

How To Calculate Federal Income Tax

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Self Employed Tax Calculator Business Tax Self Employment Self

Income Tax Co Uk Uk Tax Calculator Home Facebook

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

2021 2022 Income Tax Calculator Canada Wowa Ca

Sales Tax Calculator

What Are Marriage Penalties And Bonuses Tax Policy Center

Net To Gross Calculator

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel